These days, it sometimes feels as if the comments of almost every silver post have at least a few comments that reference cryptocurrency. A comparison of physical silver vs. cryptocurrency uncovers such vast differences that they’re almost opposites. And yet, many people apparently associate them both under a broad category of alternative investments.

Note: This article is not intended to provide investment advice and is solely for educational or informative purposes.

Comparing Silver Vs. Cryptocurrency

Lots of open-minded investors have an interest in digital money. According to Yahoo Finance, you can find about 5,392 different cryptocurrencies with a combined market cap of over $2 billion on today’s market. That’s fairly amazing, since Bitcoin only debuted in 2009, just a little over a decade ago.

Today’s top cryptos include:

- Bitcoin: With a $128 market capitalization, the OG of crypto still leads the market by a long ways. Some people call Bitcoin the driving app behind blockchain tech.

- Ethereum: Ethereum uses blockchain tech for more than only providing a cryptocurrency. It has a scripting language to code it to handle various transaction, including contracts and other documents. With a $19.4 billion dollar market cap, the second-ranked crypto has generated interest because of its utility.

- XRP: Sometimes called Ripple, XRP uses a slightly different technology than blockchain. It was developed to provide banks and payment systems with a convenient way to make payments and exchange currencies. It has a market cap of over $8 billion.

In contrast to the top-ranked crypto, Bitcoin, silver’s market cap only reached $44 billion in 2019. Even if it’s somewhat higher in 2020, it still doesn’t approach Bitcoin and may barely be twice as high as the second- and third-ranked digital currency together.

To put the time scale in perspective, scientists have found silver objects in Greece from as early as 4,000 BCE. Historians consider silver one of the metals known even to prehistoric people, so it’s first uses probably dated back even further.

Pros and Cons of Silver Vs. Crypto

As of this writing, one Bitcoin costs $10,9995. The silver spot price is just under $27. That means an investor could buy 407 ounces of silver for the cost of one Bitcoin.

Of course, people can choose other cryptos or buy fractions of a Bitcoin. Still, one advantage of silver is its accessibility to regular people.

Most people can’t come up with the resources to electronically mine for the popular electronic currency these days, so they need to either buy it from people who already own it or from exchanges. Of course, most people don’t mine their own silver either; however, silver bullion is commonly available from online markets, local coin stores, jewelry stores, and so on.

Why Silver Has Value

Silver is interesting because it’s considered both a precious and an industrial metal. That means that it’s value can depend upon it’s use as a store of value and it’s ability to provide critical characteristics to production.

This means that during both good times and bad, economic forces can pull the price in two directions. As an example, during an economic downturn, production may slow down, so the industrial demand for silver will soften. At the same time, when official currencies weaken, the value of silver tends to increase as a reaction.

Still, look at the main ways silver has become a vital part of production, based on a report from Geology.com:

- Electronics: The electrical conductivity and thermal properties of silver mean it’s tough to replace with cheaper solutions. It’s used in everything from microwaves and computers to light switches and automobiles.

- Solar panels: The growing demand for renewable energy has created a new demand for silver. Because of its reflectivity, solar cells use it to conduct electricity.

- Soldering and brazing: Strength and ductility make silver ideal for many soldering and brazing applications. It can help form tight joints for everything from HVAC to plumbing systems.

- Catalyst in chemical production: Besides its use in antifreeze, silver also serves as a catalyst for the chemical reactions needed to produce plastics.

- Jewelry and silverware: Manufacturers of fine jewelry and tableware use sterling silver because of its luster, durability, and value.

- Medicine: Silver has antimicrobial properties that people have known about for centuries. Even today, hospitals may rely upon silver-coated surfaces to help stop the spread of infections.

- Investment bullion: Not to be overlooked, silver investors, ranging from individuals to large banks, store bullion in the form of bars, rounds, and coins.

- Currency: Until a few decade ago, many coins contained a high percentage of silver. Today, people can still buy such investor coins as American Silver Eagles and Silver Canadian Maple Leafs.

So, the usefulness of silver is ironically, the thing that keeps silver from being considered as solely a store of value. On the other hand, silver tends to store value very well. In 1920, the average spot price of silver was about .65 an ounce. In those days, that would have bought a decent meal in a restaurant. Today, an ounce of silver at about $27 should still buy a good meal in a restaurant. Even in the recent past when silver hovered lower, at closer to $15 an ounce, the same could be said.

So, even though it’s possible to argue that silver isn’t used much in the kind of currency people use each day, it still fulfills the main function of currency. It stores value. It also has its own value that’s independent of exchanges because of its many uses.

Why Bitcoin and Other Cryptocurrencies Have Value

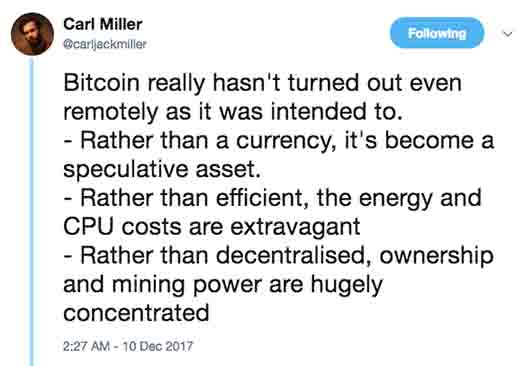

Meanwhile, Bitcoin exists only electronically. It’s stored in wallets that may exist on drives or in online services and exchanges. It serves as a speculative asset in the virtual, online world and can be used as payment.

On the other hand, it doesn’t exist at all in the physical world. As noted on Investopedia, Bitcoin value comes from its usefulness for exchanges and payments in the electronic world.

Certainly, it’s a lot easier to store an almost infinite amount of Bitcoin on a drive than it would be to store the amount of silver of equal weight. Crypto owners can carry their cryptocurrency around with them on their phones or flash drives. They don’t even have to bother if they store it online because they can use their crypto keys to access it from anywhere.

Silver or Crypto for Investing?

Of course, everybody needs to do their own research to see how they would prefer to protect their own savings. Often, this won’t be an either/or situation. Still, silver has a long history as a store of value and it’s true worth is often based upon whatever currency it’s measured in. It may rise and fall somewhat, but it’s unlikely to ever be without value just because of it’s many uses. After electronic currency has been around for a few thousand years, it might be easier to do a comparison.

Be First to Comment